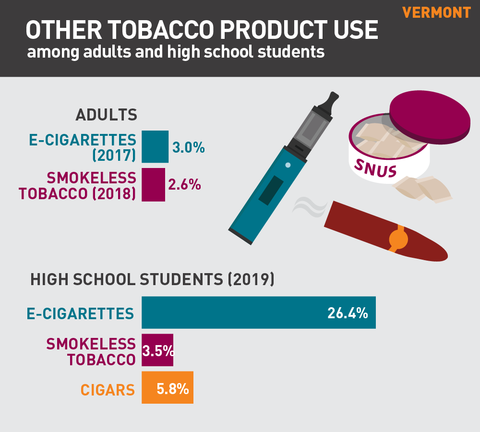

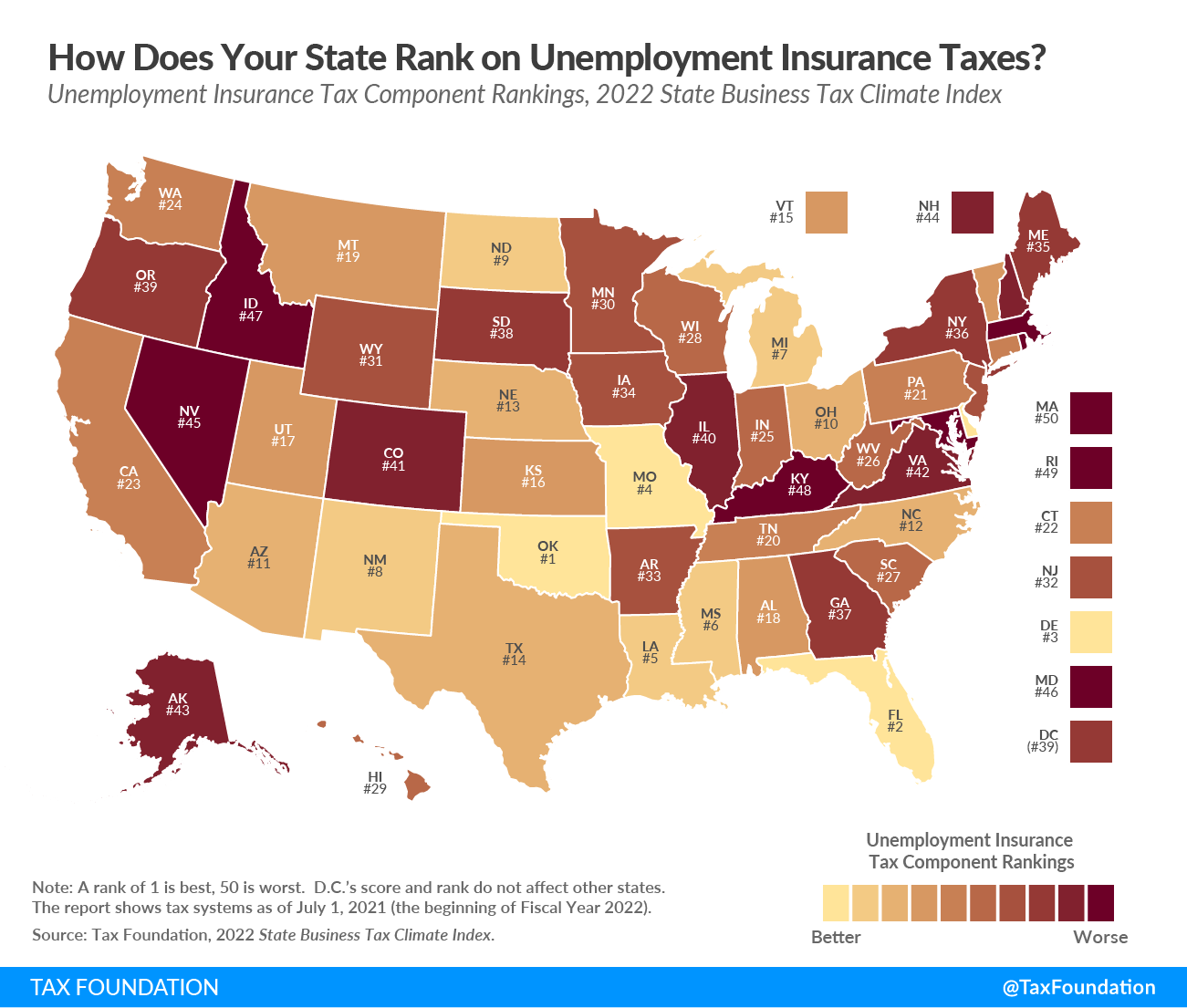

vermont income tax rate 2020

If your New Jersey taxable income is less than 100000 you can use the New Jersey Tax Table or New Jersey Rate Schedules. Please understand though that other governing authorities such as Middlesex.

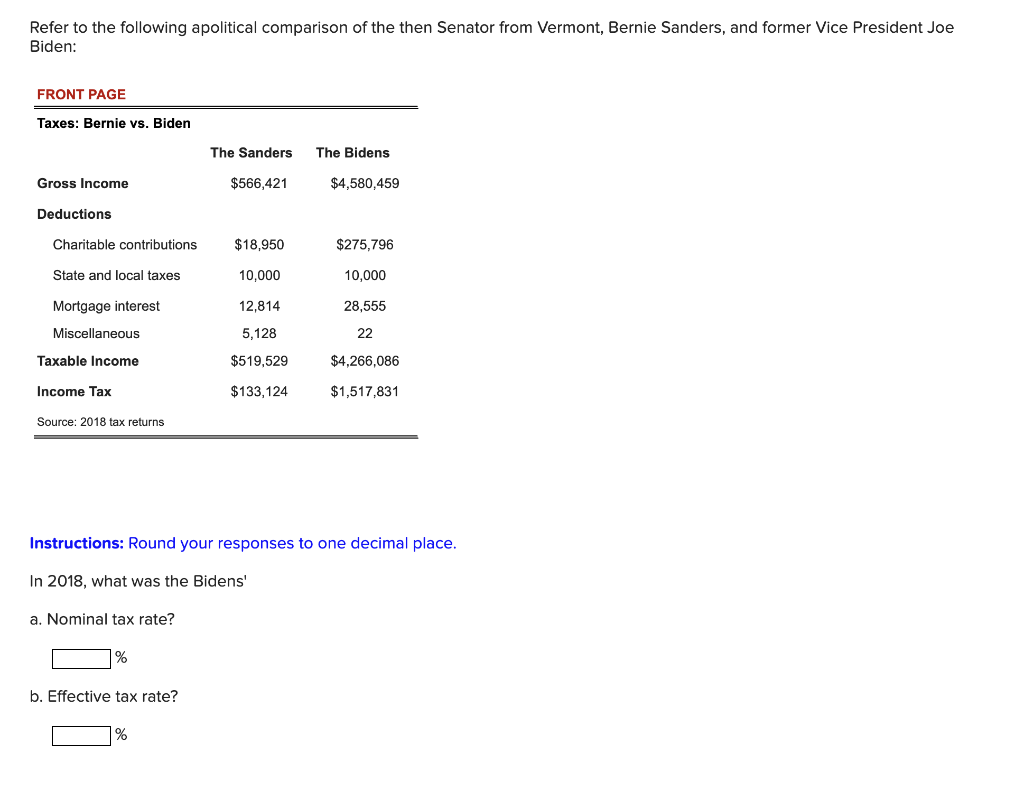

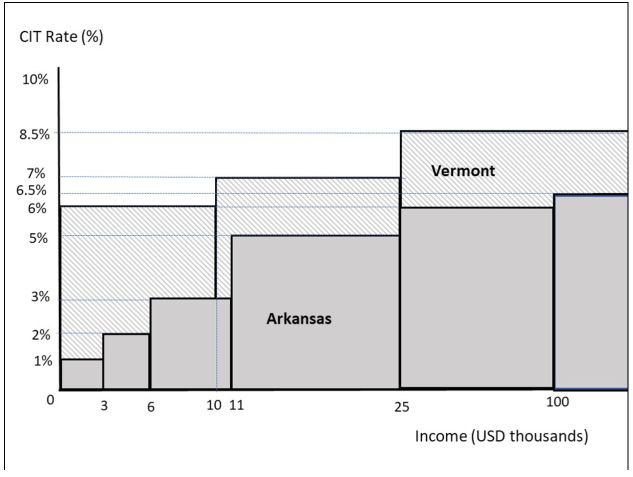

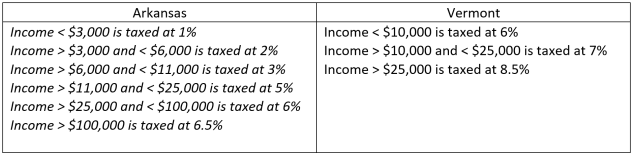

Solved Refer To The Following Apolitical Comparison Of The Chegg Com

Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid.

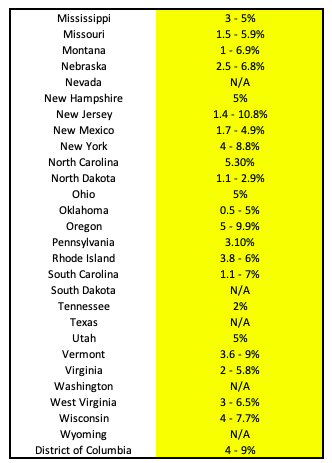

. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Form NJ-1040-H is a property tax credit application available to certain home-owners and tenants. Tax Year 2020 Personal Income Tax - VT Rate Schedules.

Vermont also has a 600 percent to 85 percent corporate income tax rate. 2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Vermonts tax brackets are indexed for.

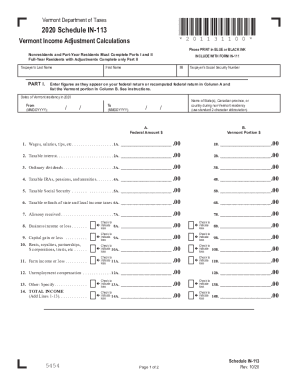

When using the tax table use the correct. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. RateSched-2020pdf 11722 KB File Format.

The Piscataway New Jersey sales tax rate of 6625 applies to the following two zip codes. 15 Tax Calculators. A list of Income Tax Brackets and Rates By Which You Income is Calculated.

This property tax credit is only available on certain years - it has been suspended by the New. Monday February 8 2021 - 1200. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US.

The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered in 2018 by 128 percent. Vermont Tax Brackets for Tax Year. Meanwhile total state and local sales taxes range from 6 to.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married. An alternative sales tax rate of 6625 applies in the tax region Middlesex. Detailed Vermont state income tax rates and brackets are available on this page.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. VT or Vermont Income Tax Brackets by Tax Year.

Historical Vermont Tax Policy Information Ballotpedia

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Personal Income Tax Department Of Taxes

Tax Rates To Increase Under School And Town Budgets Norwich Observer

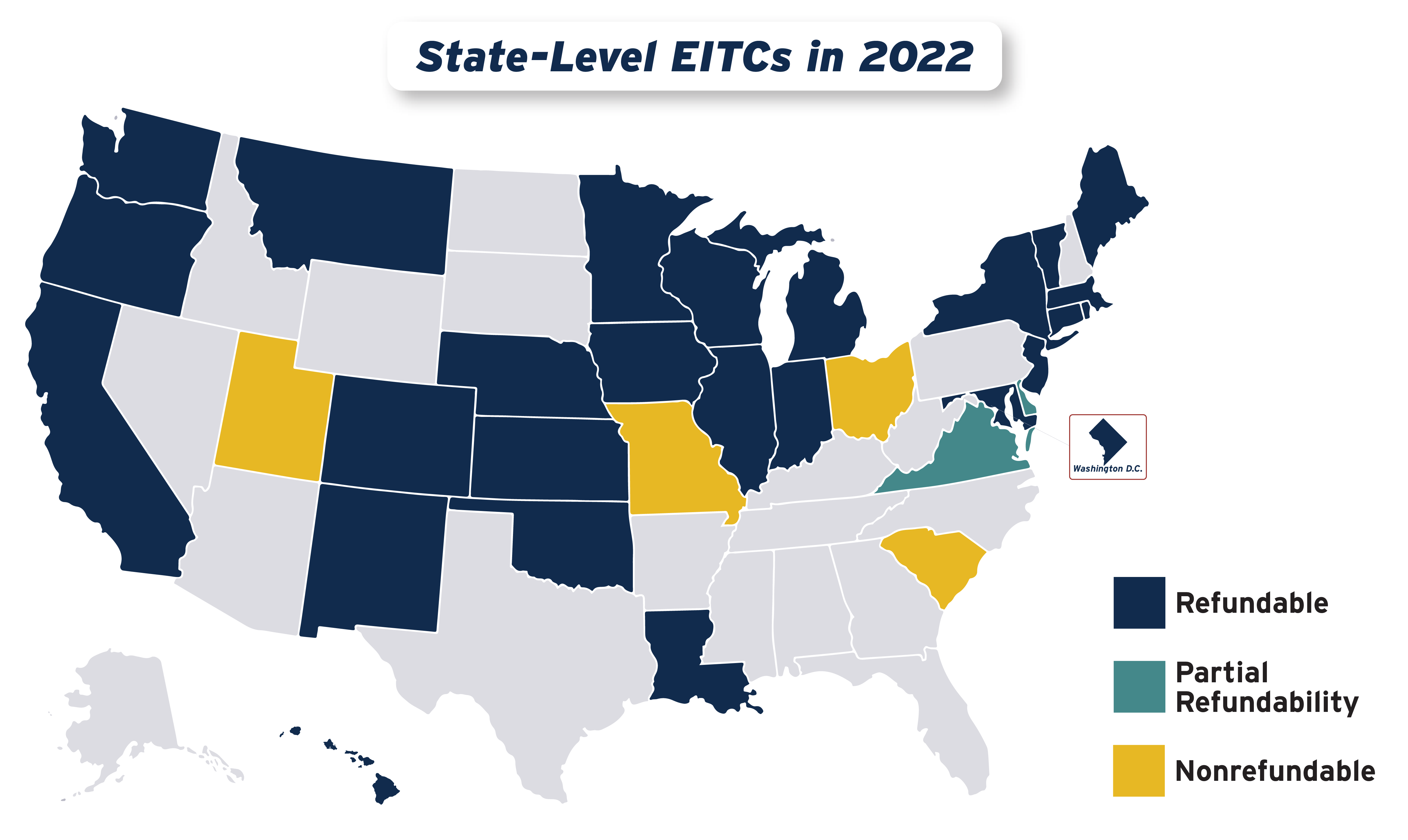

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Tax Revenues Soar With One Time Money Vermont Business Magazine

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset

Tax Year Personal Income Tax Forms Department Of Fill Out And Sign Printable Pdf Template Signnow

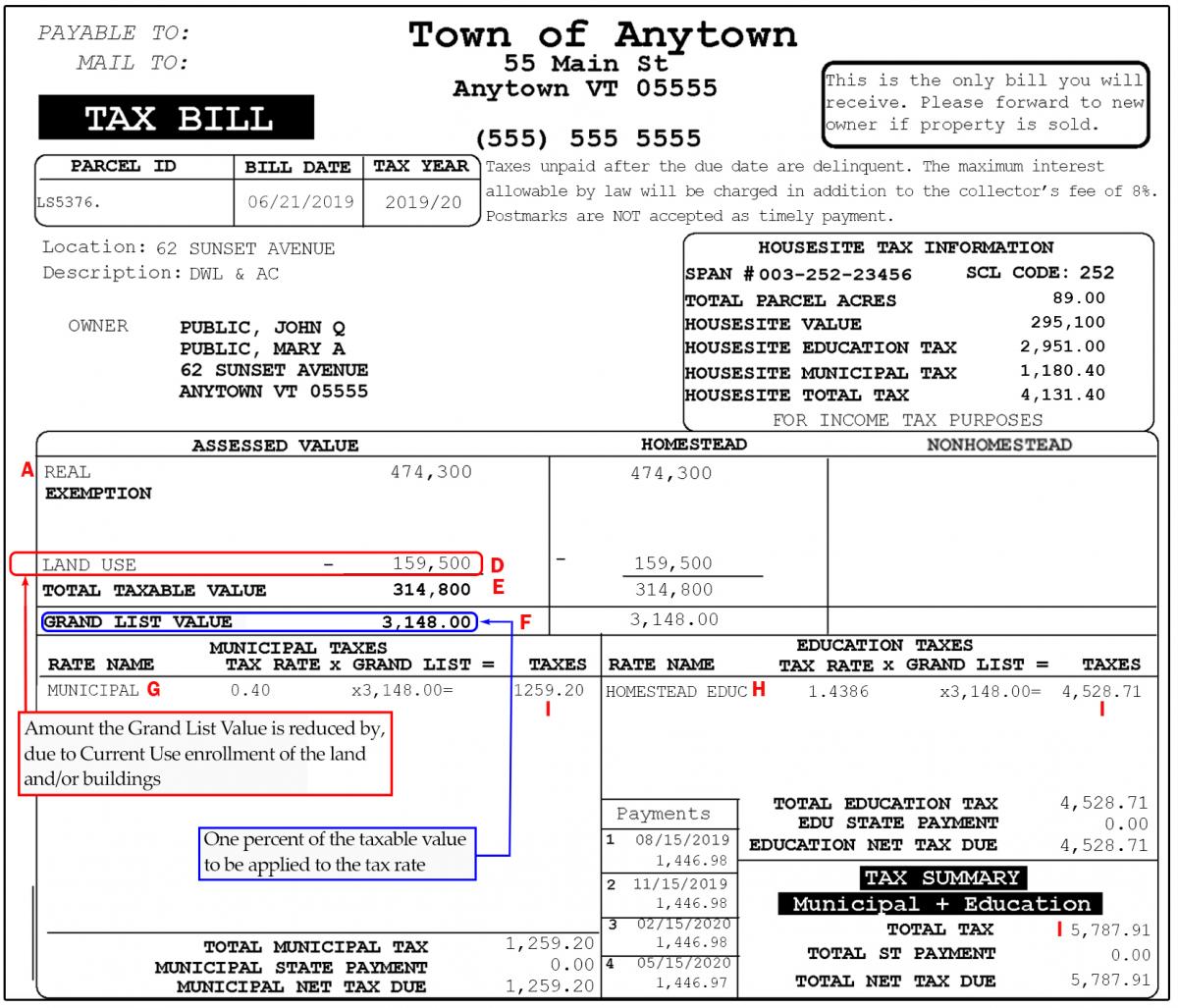

Current Use And Your Property Tax Bill Department Of Taxes

Tax Complexity And Transfer Pricing Blueprints Guidelines And Manuals

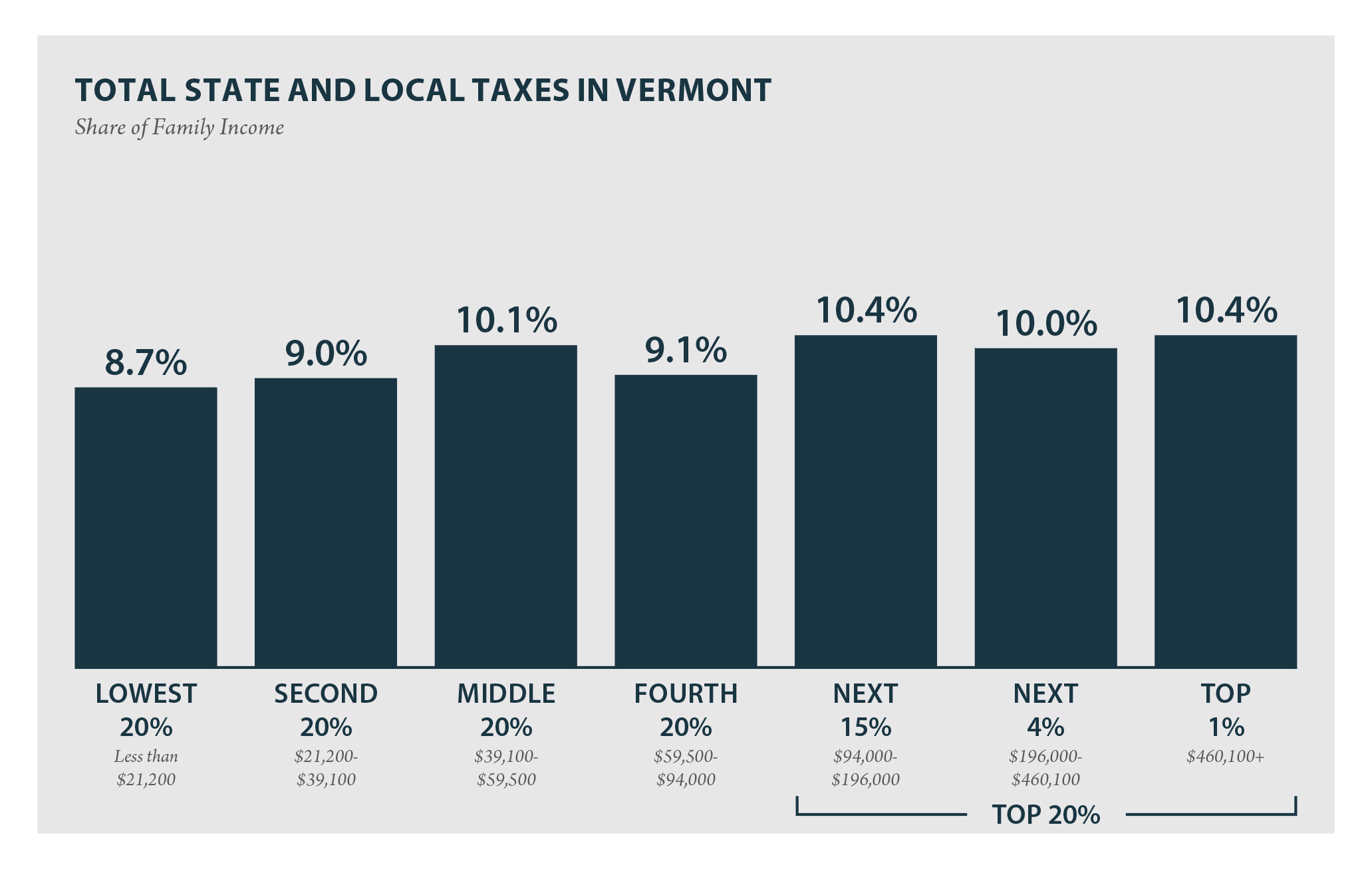

Vermont Who Pays 6th Edition Itep

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

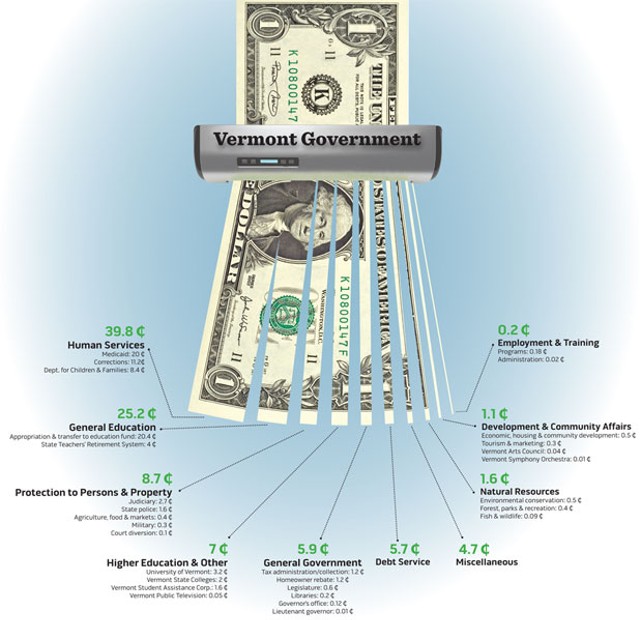

Where Do Your Vermont Income Tax Dollars Go Politics Seven Days Vermont S Independent Voice

Vermont Income Tax Vt State Tax Calculator Community Tax

Will Mississippi Join The No Income Tax Club

Tax Complexity And Transfer Pricing Blueprints Guidelines And Manuals